Eventually, exactly how much protection you have and what you pay out-of-pocket are based on the type of protection you obtain and also the automobile insurance policy deductible you select.

Figure out what to take into consideration when choosing a vehicle insurance policy deductible for your demands, budget plan, as well as way of living. What is a cars and truck insurance deductible? An automobile insurance policy deductible refers to the complete amount an insurance holder pays out-of-pocket before the insurance covers a professional event. As an example, if you obtain right into a fender bender that results in $2,000 of repair work and also you have a $500 auto insurance deductible, you're on the hook for $500, and also your vehicle insurance policy firm will certainly cover the continuing to be $1,500.

insured car cheap cheapest car cheaper car

insured car cheap cheapest car cheaper car

What makes car insurance policy protection various from various other sorts of insurance policy is that you are in charge of paying the insurance deductible each time you sue. How does a cars and truck insurance deductible job? If you get involved in an automobile crash or other sort of occurrence covered under your policy, you'll require to file a claim. insurance affordable.

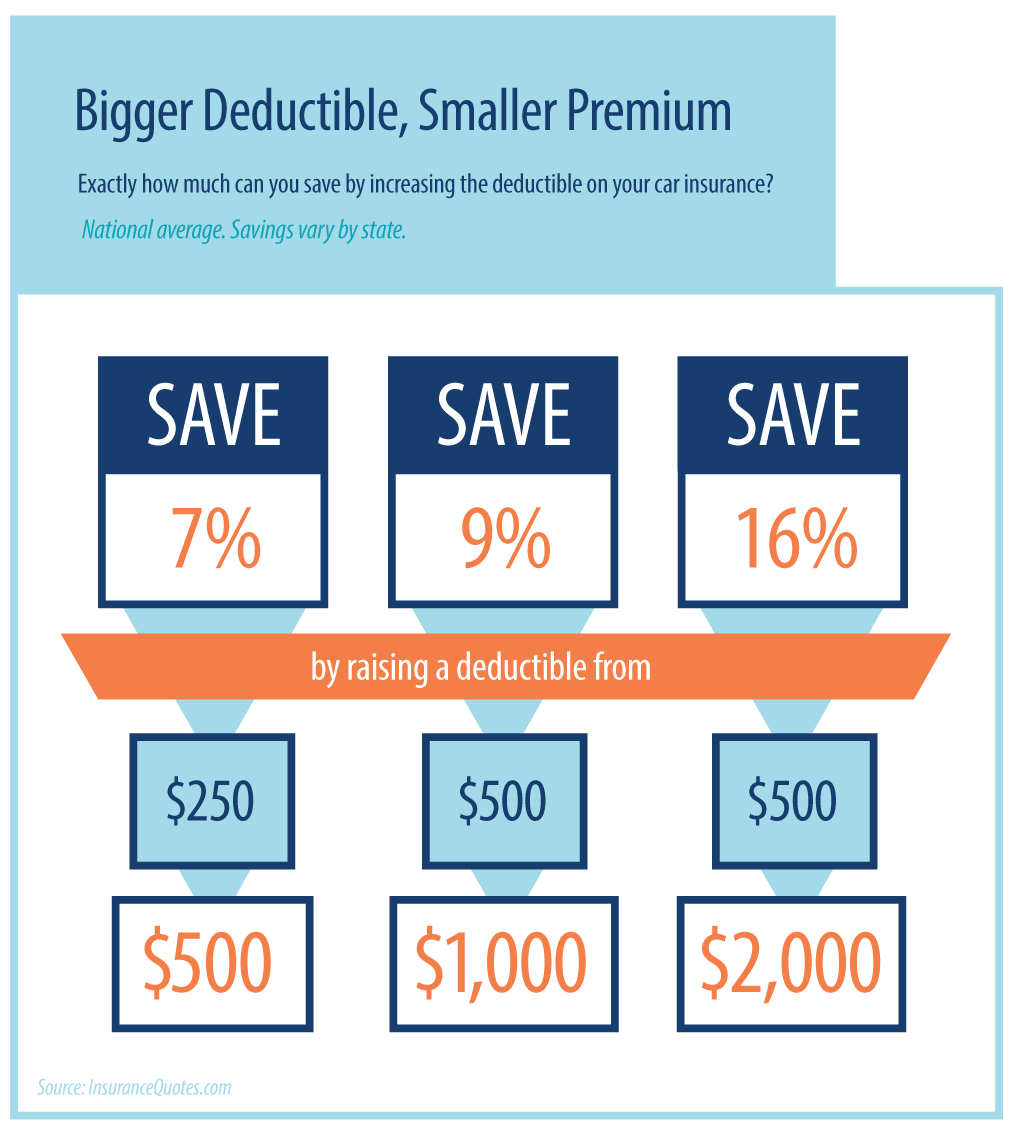

Your car insurance deductible is your obligation as well as has to be paid prior to your insurance coverage carrier covers the rest. As a customer, you can usually choose a greater insurance deductible and rack up a lower automobile insurance coverage costs.

If any type of damage or repairs are much less than the price of your insurance deductible, then it's not worth submitting a case. On the other hand, if you select a reduced cars and truck insurance coverage deductible between $100 as well as $500, the possibility of you filing an insurance claim rises. That implies you'll likely pay a greater monthly premium and be thought about even more of a threat to your insurance service provider.

What Is A Deductible In Business Insurance? - Insureon Fundamentals Explained

When do you pay the insurance deductible for automobile insurance policy? You don't have to pay your car insurance policy deductible when picking a cars and truck insurance coverage. Instead, you pay your cars and truck insurance policy costs. You need to pay your cars and truck insurance coverage deductible when you make an insurance claim. The auto insurance coverage deductible can be payable to either your repair store or your insurance supplier, depending on the amount, your strategy, and your service provider's general deductible policy.

However remember, inevitably, paying your insurance deductible is up to you. If you would instead not send a case, you do not need to pay your deductible, but you will be accountable for the entire price of your fixing - cheaper auto insurance. What are the different kinds of vehicle insurance policy deductibles? When you pick an automobile insurance coverage, you register for a certain sort of insurance coverage that can aid out in particular scenarios.

Comprehensive protection Comprehensive protection covers the expense of repairing or changing your car in scenarios beyond a common accident. So if your vehicle gets damaged in a freak hailstorm or hit by a deer, or winds up being stolen, thorough coverage will certainly involve the rescue. This sort of protection is commonly offered in tandem with crash insurance (cheap auto insurance).

cheaper dui auto insurance car

cheaper dui auto insurance car

This kind of protection aids cover the cost of repair work or any needed replacements if there's an incident. In the occasion you obtain right into an accident with a without insurance vehicle driver or one with restricted protection, this kind of insurance can assist cover costs.

This might not be supplied in every state or by every insurance service provider. Injury protection (PIP) Clinical costs are a worry for lots of people. risks. Accident security insurance can aid cover medical costs after a crash no matter that is found at-fault. Some states like New Jersey need this kind of insurance as it's thought about a "no mistake" state.

Getting My Understanding Your Insurance Deductible - Martinsburg, Wv To Work

insurance affordable cheaper car insurance affordable cheapest

insurance affordable cheaper car insurance affordable cheapest

If you select a lower cars and truck insurance deductible amount, it's likely your premium will certainly be greater. cars. While you're paying a lot more currently, if something occurs down the line and also you obtain right into a crash, you'll pay much less out-of-pocket after that. Your deductible quantity must be something you feel comfortable paying or have easy access to in an emergency situation fund, or as a last resource, a line of credit rating.

For instance, if you choose for liability-just that covers damage and injury costs for the various other vehicle driver if you're at fault. On the other hand, comprehensive as well as accident insurance coverage can cover crashes, burglary, and weather condition occasions that can come out of nowhere. You can select the deductible amount for each and every type of protection, so if you believe you are a risk-free chauffeur, it may make feeling to have a higher accident insurance deductible (where you can usually avoid a crash) versus extensive (where the events are normally out of our control).

That suggests considering your threat degrees, demands, finances, and also extra. You likewise wish to ensure you have the appropriate insurance coverage to secure on your own in numerous scenarios. And also if you don't drive significantly? You can pay much less with pay-per-mile vehicle insurance policy with Metromile. If you're still paying for miles you aren't driving, it's time to reassess your car insurance policy coverage.

In this article: When you file a case with your automobile insurance supplier, you might have to pay a deductible. This is the amount you pay out of pocket before your insurance coverage kicks in.

What Is an Auto Insurance Deductible? Unlike health insurance policy, with car insurance coverage you don't have an insurance deductible that resets every year.

A Biased View of Is High-deductible Car Insurance The Right Choice For You ...

As an example, let's say you cause an automobile mishap, as well as the total damages to your car is $10,000. If you have a $1,000 insurance deductible, you'll need to pay that quantity, then your insurance company will cover the remaining $9,000 (cheap car insurance). If your automobile is completed and also the insurance provider cuts you a look for the value of the car, it'll be minimized by that $1,000 deductible.

Deductible defined A deductible is an amount of money that you yourself are accountable for paying toward an insured loss. When a disaster strikes your house or you have a cars and truck crash, the amount of the deductible is subtracted, or "deducted," from your case payment. Deductibles are the method which a danger is shared in between you, the policyholder, and also your insurance firm.

An insurance deductible can be either a certain buck quantity or a percentage of the complete quantity of insurance on a plan. The amount is developed by the terms of your insurance coverage and can be found on the affirmations (or front) web page of typical home owners as well as automobile insurance plan - car insurance. State insurance coverage regulations purely determine the means deductibles are integrated into the language of a policy as well as how deductibles are implemented, as well as these legislations can vary from one state to another.

In the occasion of the $10,000 insurance loss, you would be paid $8,000., the insurance deductible applies each time you submit a case. The one major exemption to this is in Florida, where hurricane deductibles particularly are applied per season instead than for each tornado.

To utilize a a house owners policy example, a deductible would put on residential or commercial property damaged in a rogue barbecue grill fire, however there would be no insurance deductible against the liability section of the policy if a melted visitor made a clinical claim or filed a claim against. Raising your insurance deductible can save cash One way to conserve cash on a property owners or automobile insurance coverage is to raise the insurance deductible so, if you're going shopping for insurance policy, inquire about the alternatives for deductibles when comparing plans.

The Best Guide To Car Insurance Deductibles: Choosing Well - State Farm

Mosting likely to a $1,000 insurance deductible might save you even more. A lot of homeowners as well as occupants insurance firms use a minimal $500 or $1,000 deductible. Raising the deductible to greater than $1,000 can minimize the price of the policy. Of program, keep in mind that in the occasion of loss you'll be accountable for the deductible, so ensure that you fit with the quantity.

In some states, insurance policy holders have the alternative of paying a greater premium in return for a conventional dollar deductible; nevertheless, in high-risk seaside locations insurance companies might make the percent deductible obligatory. job in a similar method to cyclone deductibles as well as are most usual in locations that typically experience severe windstorms as well as hail storm. cheaper car.

Wind/hail deductibles are most typically paid in percents, typically from one to 5 percent. If you haveor are considering buyingflood insurance policy, see to it you understand your insurance deductible. Flood insurance policy deductibles differ by state and also insurance provider, as well as are readily available in buck quantities or percentages. You can pick one deductible for your house's structure and also an additional for its materials (note that your home loan company might need that your flood insurance policy deductible be under a specific amount, to help guarantee you'll be able to pay it).

Insurance firms in states that have greater than ordinary threat of quakes (for example, Washington, Nevada as well as Utah), often established minimal deductibles at around 10 percent. In California, the fundamental The golden state Earthquake Authority (CEA) policy consists of an insurance deductible that is 15 percent of the substitute expense of the primary residence structure and also beginning at 10 percent for additional protections (such as on a garage or various other outhouses).

Your auto insurance policy deductible is typically a collection quantity, claim $500. If the insurance adjuster identifies your claim quantity is $6,000, as well as you have a $500 deductible, you will receive a case repayment of $5,500.

The Basic Principles Of Car Insurance Deductibles Guide: 5 Key Things To Know In 2022

Deductibles vary by policy as well as chauffeur, and you can select your car insurance coverage deductible when you purchase your plan.

Contrast quotes from the leading insurance policy firms. Which Automobile Insurance Policy Protection Types Have Deductibles? Equally as there are different sorts of cars and truck insurance policy coverage, there are varying deductibles based on those various kinds of protection. It's essential to recognize just how much the automobile insurance coverage deductible is for each kind, so you'll know what you're expected to pay in case of a claim (low-cost auto insurance).

Liability auto insurance coverage does not have a deductible. This coverage pays your expenditures if your cars and truck is harmed by something aside from a crash with one more vehicle or things. This can consist of repairing damages from hail storm, striking a deer or replacing a fractured windscreen. cars. It additionally will certainly pay to cover the price of replacing taken products.

This protection spends for repair services to your vehicle when you are at mistake (cheaper auto insurance). This could be when your vehicle is harmed in an accident with an additional lorry or an object such as a tree or wall. This insurance deductible is usually the greatest insurance deductible you will certainly have with your vehicle insurance coverage.

Because instance, you would certainly not pay a collision insurance deductible. Accident security coverage pays the medical costs for the driver as well as all passengers in your cars and truck. Uninsured vehicle driver protection pays your expenses when you are in an automobile crash with a chauffeur who is at mistake yet does not have insurance or is insufficiently guaranteed to cover your costs.

Indicators on What Is A Car Insurance Deductible? – Forbes Advisor You Should Know

What Is the Ordinary Insurance Deductible Price? Because consumers pick varying sorts of automobile insurance policy protection with various monetary restrictions, deductibles can vary significantly from one driver to the following. For a lot of drivers, typical insurance deductible amounts are $250, $500 and also $1,000 (insured car). According to Cash, Nerd's information, the ordinary auto insurance policy deductible quantity is approximately $500.

Your vehicle insurance coverage deductible will vary based on that protection as well as the price of your costs. Normally speaking, if you choose a policy with a higher insurance deductible, your premium will be lower. This can be a terrific choice as long as you can pay that higher deductible in case of a crash.

You can conserve an average of $108 per year by enhancing your deductible from $500 to $1,000 - insured car. For those with limited budget plans, picking a reduced costs and also a greater deductible can be a method to guarantee you read more can spend for your cars and truck insurance policy. Nevertheless, if you can afford it, paying a greater premium can imply you don't have to come up with a great deal of cash money to pay a lower insurance deductible in case of an accident.

It is very important to have your concerns relating to car insurance deductibles answered before that occurs, so you understand what to expect (automobile). Broaden ALLWho pays a deductible in a mishap? Do you pay if you're not to blame? When there's a vehicle mishap, the at-fault chauffeur is needed to pay the vehicle insurance coverage deductible.

If the at-fault motorist does not have insurance coverage or adequate insurance policy to cover the other motorist's expenditures, the no-fault chauffeur can utilize his automobile insurance policy as secondary protection to pay the prices - car insured. When do you pay an insurance deductible if you are required? Generally, if you are required to pay a cars and truck insurance deductible, the quantity of the insurance deductible will certainly be deducted from your insurance claim settlement when it is provided.